News & Tips

2026 Market Outlook

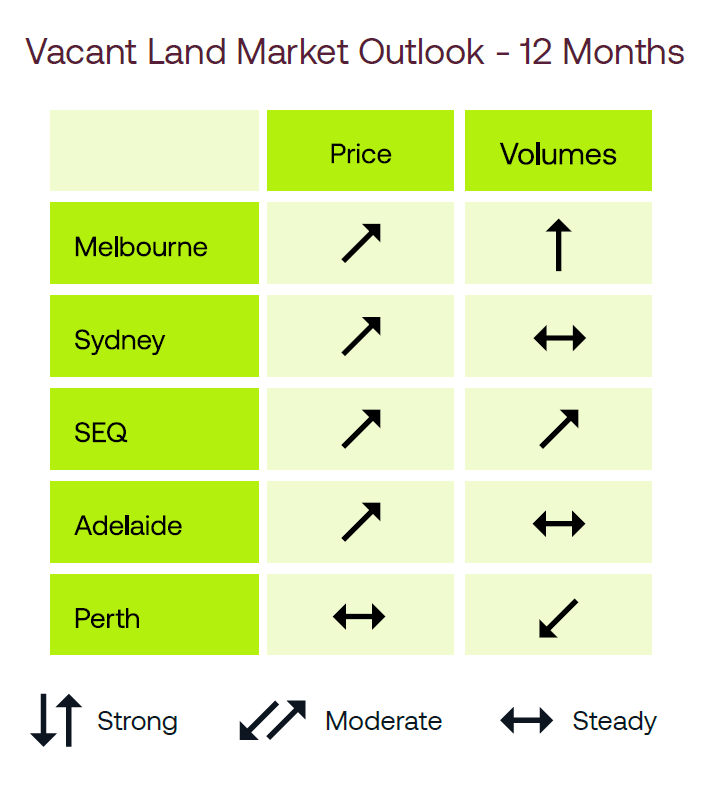

Despite a fast-changing interest rate outlook, land and built form property markets are set for a positive 2026.

The outlook for interest rates, a key driver of the improvement in land markets to date, has been a wild ride through the September quarter. After the market locked in a November rate cut, the release of some pretty ugly inflation numbers for the September quarter knocked that on the head. Core inflation rose above RBA forecasts and market expectations to 3.0%, and new forecasts from the RBA have it moving above the target zone until the second half of 2026.

The RBA therefore surprised no one and held rates steady on 4 November. All eyes now move past 2025 and into 2026 to answer the question of when (or even if) the next rate cut comes. Markets currently expect just one more rate cut by mid-2026, with a 50% chance of it coming by March. That decision will be driven by September and December quarter GDP releases, monthly unemployment levels and of course, the quarterly inflation releases in late January and April.

However, fundamentals remain strong. Population growth is easing from post-COVID highs but is forecast to remain as one of the highest rates of growth in the developed world and strong in an historical context, providing plenty of underlying demand for housing. Unemployment remains low, supporting household incomes. Economic activity, driven by rising household spending, is strengthening, and is the key reason why the rate cycle is shorter than initially expected.

Compared to recent years of undersupply, we believe the market will move toward a more balanced position over the next 12–24 months as population growth slows and supply increases. In the shorter term, we see three key dynamics at play in the land market: rate cuts, first-home buyer incentives, and established dwelling price growth. Together, these factors should support strong price growth over the next 12–24 months nationally. Relative affordability at a state level compared to the national benchmark will drive varying price performance across different markets.

Melbourne

Melbourne Land Market Set for Strongest National Recovery in 2026

Australia’s biggest land market is expected to enjoy the strongest recovery in the country in 2026, although we believe it will remain below longer-term average activity levels. Volumes and prices have been subdued for three years, resulting in sales well below levels of underlying demand, resulting in pent-up demand. Combined with a move towards positive net interstate migration, a recovering established housing market, and the best relative affordability compared to other major land markets in decades, we expect to see sales volumes continue to grow strongly in 2025 and 2026, with prices following in 2026 after the current incentives and rebates are worked through.

Sydney

Sydney’s Affordability Crisis Continues as Demand Outpaces Land Supply

A market that has been chronically undersupplied for years, Sydney is the poster child for what occurs when land supply does not keep up with demand over the long term. Sydney has the lowest affordability in the nation. With underlying demand still well above what the market can supply, this imbalance has translated into price growth. While falling rates will increase this demand, the impact will be less pronounced than in other markets because of the large gap between first home buyer borrowing capacity and current market prices. We expect moderate increases in sales volumes, still constrained by supply issues, with prices to remaining under significant pressure.

South East Queensland

Moderate Volume Gains and Price Growth to Ease from Current High Levels but Remain Positive

In a market that has performed strongly for most of 2024/25, the upside is more limited compared to Melbourne. One reason is that it is already operating close to the market’s ability to deliver new supply. Another is that, at the start of 2025, it lost its land affordability advantage over Melbourne. Still, rate cuts will undoubtedly be a positive driver, and a very strong established market means new house and land packages remain an attractive option for many buyers. We expect volumes to push moderately higher and price growth to ease from the current high levels but remain solidly positive.

Perth

Perth’s Strong Cycle Easing, followed by a Gradual Softening of Price Growth

The strength of the current cycle has been driven by an uplift in net interstate migration and strong investor activity, attributed to affordability and attractive rental yields. Like most capitals, supply has also been an issue, with new land releases not keeping up with underlying demand. Investor activity is likely to ease as capital and rental growth slows, with attention returning to eastern markets, primarily Melbourne. Recent buoyant price growth has eroded some of Perth’s affordability advantage. We expect some easing of sales volumes in what has been the strongest market in the country for the last few years, followed by a gradual softening of price growth later in 2026.

Adelaide

Underlying Demand Sustains Adelaide Price Growth Despite Supply Bottlenecks

With low sales volumes and infrastructure bottlenecks hampering new supply, it’s clear that the underlying demand exists and is being translated directly into price gains. While the State Government has made moves in the right direction, turning these initiatives into actual new supply will be slow. With increased demand due to rate cuts, we expect sales volumes to increase in line with new supply as it’s released. The very strong price growth seen over the last three years (~20% per annum) is expected to ease back to levels more in line with established market growth.

Julian Coppini

Chief Executive Officers

Oliver Hume Property Group