News & Tips

Gold Coast apartment sales retreat for first time since 2011

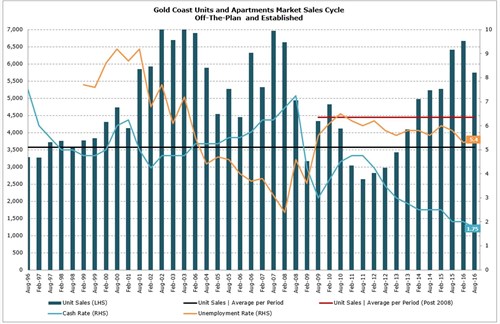

Gold Coast apartment sales have recorded their first half-year decline in five years but remained “very healthy” at more than 60 per cent above long term averages, according to new research conducted by property services group Oliver Hume.

The research showed there was 5733 sales of new and established apartments in the six months to the end of August 2016, compared to 6667 in the previous six months to May, marking the Gold Coast’s first half-year apartment sales decline since February 2011.

Oliver Hume Joint Managing Director Queensland Marcus Buskey said the market was now showing signs of self-regulation after emerging from the “unsustainable” nine-year high of 6667 sales recorded from December 2015 to the end of May 2016, according to the report.

“Tightening lending conditions from both the retail and commercial banking sectors has softened investor demand and regulated the Gold Coast’s supply pipeline with a slowdown in the number of new apartments hitting the market,” he said.

“With tighter lending conditions across the state and increased construction and marketing costs, the supply pipeline has begun a self-regulation process,” Mr Buskey said.

“Gold Coast unemployment currently sits at 5.4 per cent representing the lowest level since February 2000 during the Global Financial Crisis and this combined with a strong demand for units is a major reason behind this result.”

“We are seeing the Gold Coast market returning to a sustainable level of activity while also providing the market with time to absorb the current available stock,” he said.

Mr Buskey pointed to the affordability of Queensland compared to other states as a “prime opportunity” for investors.

“Although affordability is an obstacle in cities such as Sydney, there are major opportunities for buyers in prime east coast markets such as the Gold Coast.

“That opportunity is the impending oversupply of new apartment stock largely in Melbourne and Sydney.”

Mr Buskey predicted that a number of approved or pending-approval projects may be postponed until future cycles and that apartment supply “will peak” in the lead-up to the 2018 Commonwealth Games.

“Comparative affordability and high rental returns are the ongoing key drivers for investors on the Gold Coast.

“As other eastern-seaboard apartment markets battle with supply concerns and/or weaker rental market conditions, the Gold Coast has benefitted from representing an alternative investment option,” he said.

“The upcoming Games means the underlying value of Gold Coast apartments will continue to strengthen,” he said.

Mr Buskey said the Gold Coast has a strong development pipeline in place with an emphasis on dense developments in the town centres of Southport, Surfer’s Paradise and Broadbeach as a direct result of the State Government’s designation of Southport as a Priority Development Area (PDA).

Mr Buskey added that the pullback on infrastructure spending in Queensland had flowed through to the domestic economy.

“Queensland has been hard hit by the infrastructure slowdown resulting in weakness in the Queensland economy including the consumer sector.

“But, investor demand for apartments is expected to remain stable as investors continue to seek alternatives to the Sydney and Melbourne markets.”

“The RBA has lowered interest rates twice this year to record lows. Economists see potential for further cuts if inflation stays low and we expect the next 12 months to deliver stability underpinned by strong employment and low interest rates."